Despite experiencing a strong history of growth as an industry, FMCG brands today face huge upcoming challenges. One way to tackle them is understanding the evolving needs of consumers tomorrow.

But what is FMCG?

Short for fast-moving consumer goods, the umbrella term describes everything from dry food and toiletries, to over the counter medication and beverages. They’re goods with a short shelf life, such as beauty and hygiene products, and are rapidly consumed and replenished within days, weeks and months. FMCG have a relatively low-profit margin, but they account for more than half of all consumer spending. By 2010, FMCG brands made up 23 of the world’s top 100 brands.

It’s a broad sector, so for the purpose of this post, we’ll be focusing on hygiene and beauty FMCG. We will address a shift in consumer behavior, the insights your brand should look out for to address their expectations, small and medium-sized disruptors, and some ways the traditional FMCG model can adapt.

Let’s dive in!

The importance of consumer insights for FMCG brands

With an overwhelming variety of options on the market, the success of these products depends on a huge range of factors including consumer trends, packaging, distribution channels, brand equity, and marketing strategies.

Buyer behavior towards traditional FMCG is pretty indifferent. There’s no emotional connection to a disposable razor, but sure there is a growing consciousness of the way it’s impacting the environment. Combined with wavering loyalty and demand for online convenience, a major FMCG problem is that it isn’t changing at the pace of consumer expectations.

Smaller challengers entering the market

The industry is seeing smaller and mid-sized companies enter the market using more flexible methods of production, alternative distribution options, and choices for more niche, ethically conscious consumers. The traditional goal of FMCG goods is to target the masses, but can this model continue?

Source: McKinsey & Company, Perspectives on retail and consumer goods 2019

Luckily, the industry is just as abundant in data as it is in products, so there’s no better time to find new ways to hear your consumers.

It’s time for FMCG conglomerates to listen, innovate, and convince the next generation of tech-savvy consumers. But what do they want and how can this global industry focus on brand value over synergy?

What the next generation of consumers want from FMCG

The next generation of consumers has higher expectations and demands for convenience. They would happily bypass brick and mortar stores and well-known household products, to purchase from new direct-to-consumer brands.

They’re over one-size-fits-all marketing and are increasingly drawn to personalized and customized goods because they help eliminate the overwhelming choice of products on the market.

The growing success of small and private label brands as seen in the graph above favors consumer perception that traditional retail really has gone stale. Accessibility no longer refers to the physical location of a brand, but the technologies, digital presence, and relevance it holds online.

How should FMCG brands leverage consumer insights

In this section, we’ll dig deeper into the different ways you can collect consumer insights, and where you can find them.

Understanding your audience

Savvy and connected consumers are challenging an industry that’s historically targeted the masses with one-size-fits-all goods. When discussing hygiene and beauty products, there’s generic segmentation of male, female and age-specific goods. But what’s changed is the consumer demand for higher levels of personalization and customization.

To ensure sustainable growth in the future, avoid leftover stock, lower margins and lower revenue, brands need to realize the advantage of knowing more about their individual customers.

And there’s no better way to understand them than through social.

In today’s market, brands need to go one step further to find the ‘tribes’ behind the purchases. This means identifying social proxies through the behaviors, interests, and activities of consumers. Knowing what people discuss, what they care about, how they use your brands and competitor products, allows you to build profile subcategories for better targeting.

How to target your audience based on tribes

Case study: Procter & Gamble

One conglomerate taking steps to better understand their tribes is FMCG giant, Procter & Gamble. The hygiene and beauty specialists have shifted their attention away from generic demographic targeting to what its calling “smart audiences”.

Using more than 1 billion consumer IDs, P&G is building audience segments to conduct “propensity marketing with people who have similar characteristics” or simply put, target marketing to different interest groups, or what we call, “tribes.”

Moving away from generic targeting e.g women from 18 to 35, it created over 350 specific smart audiences including millennial professionals, first time washing machine owners and first time mums.

By targeting these tribe subcategories with specific messaging and marketing campaigns, it helps serve the right people and their specific needs, at the right time. P&G also uses these tribes to test new products. Overall, targeting tribes has managed to improve P&G’s entire business strategy, streamlining its innovation pipeline to save valuable time and money.

Back in 2012, it also created an analytics model called “Business sphere”, eliminating manual collection and aggregation of consumer purchases. It collects real-time consumer data around the globe to analyze purchasing patterns and triggers, instantly.

By eliminating the delay of manual collection and data aggregation, this business intelligence system improves productivity and collaboration, simplifies work processes, reduces the decision-making cycle time, and enables P&G to focus on their most pressing task: innovating products.

These strategies combined helped its 2019 net sales rise 7% to $17.80 billion, exceeding expectations of $17.42 billion.

All that, just by harnessing consumer data!

But like many FMCG, not every product performs well. When you look at P&Gs shaving segment in the final quarter of 2019, it grew sales of the year to just 1%, dragging down the value of its Gillette brand by $8 billion dollars. One reason is a hugely unpopular YouTube campaign, that missed the mark with its messaging.

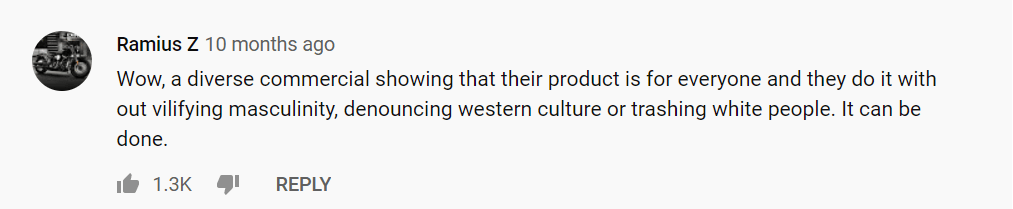

Authenticity matters

We live in a time where consumers are beginning to buy with their hearts, based on their values. Gillette aimed to re-brand their outdated slogan, ‘The best a man can get’, by tackling the controversial subject of toxic masculinity. It addressed the #metoo movement and depicted a series of negative, male gender-stereotypes, attempting to influence social justice. But the mixed response left it labeled the most expensive ad in history. With 2.5 million thumbs down on YouTube as of December 2019, it’s a valuable lesson on what doesn’t work with the next generation of consumers. Despite their good intentions, the message behind a humble razor may have been too profound to reach a younger audience in search of authenticity.

Dollar Shave Club

Another reason is a rising wave of direct-to-consumer brands like Dollar Shave Club. Since conception in 2012, the organization has successfully leveraged the power of social media. It succeeded where Gillette failed and appealed authentically to real people, using real people. Its most recent acclaimed YouTube campaign uses the slogan ‘Whoever you are, however you get ready…’ can resonate with all viewers. Channeling body positivity, the brand literally puts the spotlight on our bathroom shaving routines. Lighthearted, funny, and diverse the brand managed to target a mass audience through inclusion, stealing the hearts of GenZers, Millennials, and Boomers in search of affordable razors.https://www.youtube.com/embed/QEU-MAZRhJs

The brand has experienced growing success, including acquisition by Unilever for $1B in 2018, thanks to four key ingredients:

- Direct to consumer service. A seamless buyer experience from start-to-finish, tapping into the consumer demand for convenience.

- Subscription model. Effortless replenishment of products at home, that influences customer retention.

- Personalization. No more buying, testing and wasting products. Consumers can answer a quiz and identify the products right for them.

- Marketing feedback loop: Every customer reaction is met with a response. Company-wide access to data analytics that pinpoints wins/losses, customer data tracking, and email activity.

The key takeaway from Gillette and Dollar Shave Club is the importance of gathering insights to truly understand your audience. FMCG products don’t tell a story, so its down to you to evoke an emotional connection with consumers through authentic messaging.

Analyze and predict social media trends

We’ve touched on a good example of how understanding your audience can boost sales and reduce losses. But the important question remains. How can you easily gather consumer insights for your brand?

Monitor trending social media topics

There’s no media more up-to-date than social media. It’s a modern-day ritual for consumers to share their latest accomplishments, desires, and purchases online. It’s also the chance for you to leverage this real-time information and understand major trends in conversation.

Unlike traditional focus groups and surveys, social media provides you with instant buyer feedback on virtually any topic, product or service.

Use the top-rated comments to address concerns and highlights around your latest product campaigns. Establish common themes among your top target segments and the concerns of potential prospects. You’re creating the products, but it’s consumers who decide how they’re used, and how successful they become.

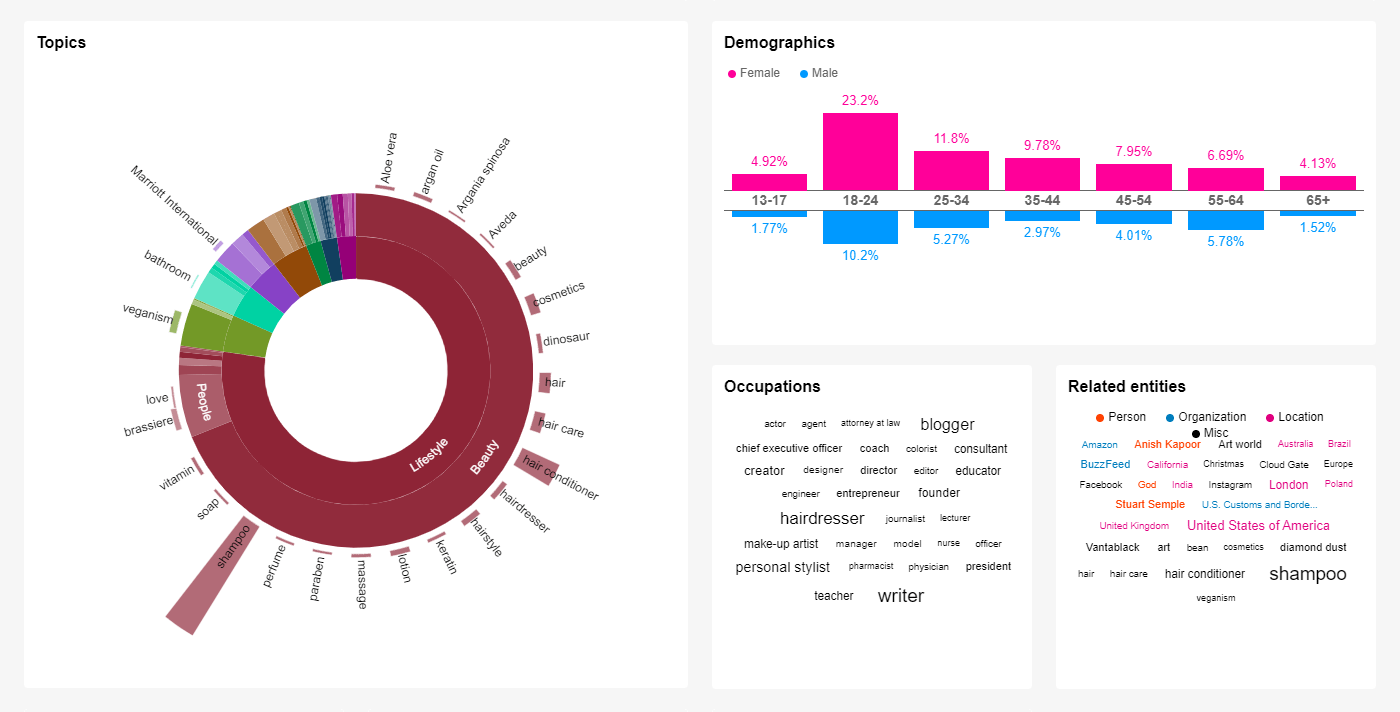

For example, a quick glimpse at conversations about the topic “shampoo” provides a wealth of information:

Source: Linkfluence Search

Brands can quickly see who’s discussing this item most, their age and gender, and other key topics associated with the term.

Identify key market segments

You could also limit this search to only include Millennials or Gen Z, and see whether “shampoo” for example is a highly appealing or indifferent topic for this segment in different locations.

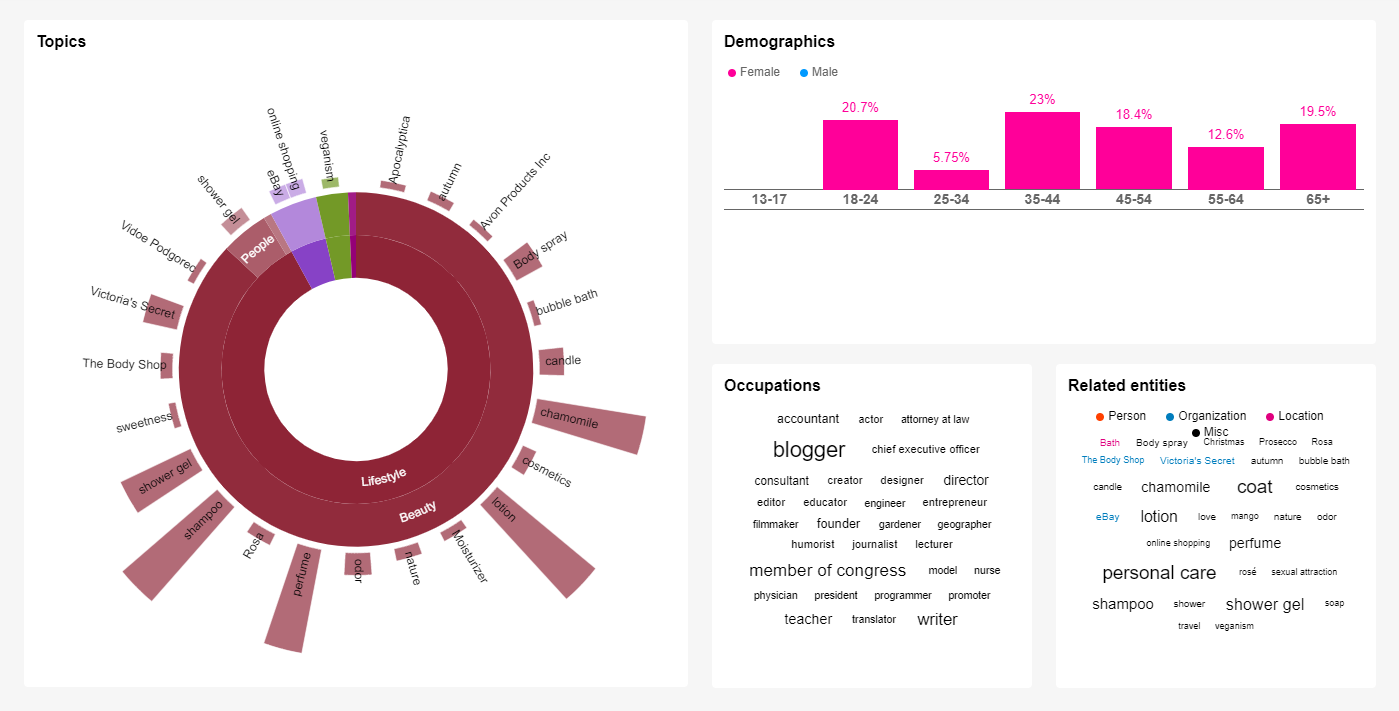

Likewise, you could monitor this segment for general terms like ”hair care” or “shower gel” and look for the topics that keep coming up. For instance, among female Twitter users, here’s what we found:

Source: Linkfluence Search

It may surprise FMCG brands to learn that Avon and Victoria Secret are discussed for their shower gels. They can dive into conversations about those specific brands try to identify the characteristics that make them more popular.

You can also find out what’s the most common occupations of your target segment, what’s their favorite online platforms, and other behavioral and demographic information that will help you better target them.

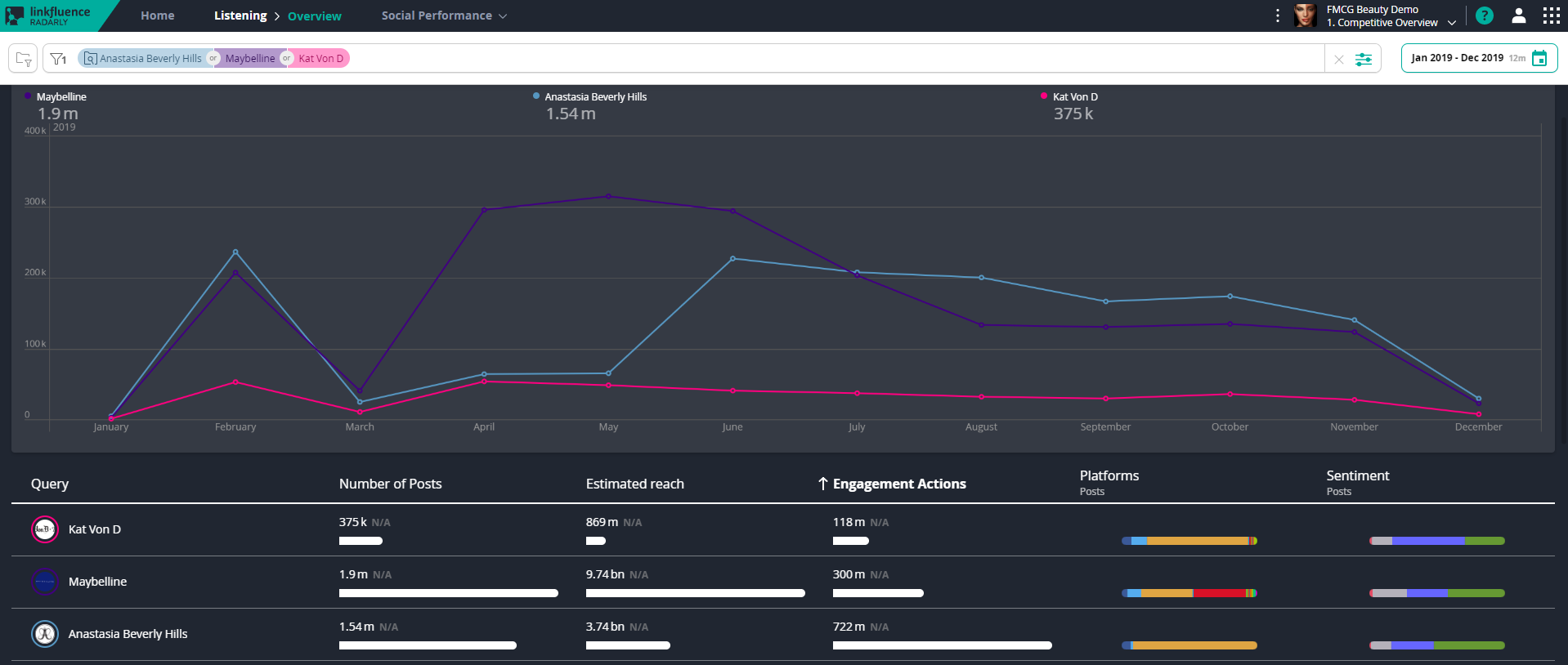

Measure against and learn from competitors

In fact, a close look at other industry brands can tell you a lot about your own. If you know what their customers say about them on social media, you can quickly figure out the best aspects of their product and marketing strategies.

You can also identify key segments that you might be missing out on. For example, if you discover that a competitor sees a lot of social media chatter in eastern Europe or Asia, you may consider increasing your efforts in these markets.

Another simple strategy is to look for spikes in conversations about your competitors:

Source: Radarly

- What caused these sudden jump in mentions?

- Were they positive or negative?

- And if they were positive, can you replicate their strategy for your own brand?

All of these conversations are out in the open online. You can easily learn exactly what motivates your competitors’ customers, which of their products they love best, and in which markets they’re having the most success.

Analyze the performance of your brand

As a global brand, if you’re not already, it’s paramount to be analyzing social media conversations. Extracting a range of insights concerning your brand equity means you can identify major strengths and weaknesses. A huge amount of value lies in real-time global data on the social web that can help to improve communication, marketing, and media investments.

Global brands should be finding ways to qualitatively measure their social media chatter as well as their key competitors.

Social media is rich with consumer insights for FMCG

Consumers are used to seeing the latest FMCG campaigns on social media. For brands it’s a great way to raise awareness and attract new customers. Burger King is a great example of a brand that’s created a reputation for itself. By mastering humor and creativity its managed to create a loyal following on twitter, opening doors to receive, collect and respond to consumer feedback.https://platform.twitter.com/embed/index.html?dnt=false&embedId=twitter-widget-1&frame=false&hideCard=false&hideThread=false&id=1202649991925379074&lang=en&origin=https%3A%2F%2Fwww.linkfluence.com%2Fblog%2Fhow-to-find-consumer-insights-for-fmcg&siteScreenName=linkfluence&theme=light&widgetsVersion=ed20a2b%3A1601588405575&width=550px

Social media gets you noticed. But have you noticed the wealth of data and insights available to you through social media?

Social data can tell you:

- What consumer preferences are being searched

- Who cares most about a certain product, and their response to it

- Where products are likely to perform the best

- When you can reach consumers with ease

- Why they choose other brands over your own

All you need to do is pay attention.

Tools like Linkfluence Tribes, Search and Radarly can help you mine billions of social media conversations to pinpoint consumer insights that can actually help.

If you’d like to have a conversation about social media intelligence and how it can help you make smarter business decisions for your brand, get in touch! Or take a peek at our customer case studies page to see how we’ve helped other global brands.

Source: https://www.linkfluence.com/blog/how-to-find-consumer-insights-for-fmcg